|

||

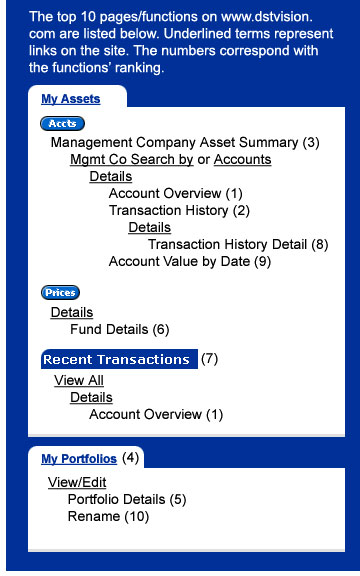

Learn More about Vision from Advisors Who Frequently Use the Site On a monthly basis, more than 55,000 advisors – a 40 percent increase over this time last year – take advantage of what DST Vision offers. Recently, we analyzed site activity and identified the most popular functions. If your activity doesn’t mirror these trends, then consider looking into these functions to boost your productivity. The top 10 pages/functions are ranked highest-to-lowest based on the number of visits during the 2nd quarter of 2004: 1. Account Overview

As you can see, Vision provides you the opportunity to manage your business in whatever way suits you best. If high-level information is what you need, the Management Company Asset Summary and Portfolio List pages might be right for you. When preparing a client presentation that requires more detail, consider the Account Overview, Transaction History, and Fund Details pages. Improved Access to Portfolio and Household Value Information Since its introduction in 2001, Vision’s “My Portfolios” feature has been extremely popular. Today, nearly 40,000 advisors have established more than four million portfolios containing over 13 million accounts. Based on advisor feedback, we recently enhanced the feature to make it even better.

With the addition of value information to the My Portfolios and My Households list pages, you can now view and organize your entire book-of-business in a single list. Previously, this information was available only by searching for individual portfolio or household values on the Portfolio Details and Household Details pages. In addition to the value, the daily percentage change displays as well, allowing you to quickly assess the daily impact of the market on the performance of individual portfolios/households.

You can further leverage your portfolio/household lists by using the “Reports/Export” feature. Printable reports also include the important value and % change information, and it is available in the ‘Export to Excel’ functionality as well. Portfolio- and household-level detail can also be exported in a Morningstar-compatible format. Since these changes were implemented, we have received compliments such as the following:

If you have questions about this or any other Vision feature, contact a product specialist at 800.435.4112 or dstvision@dstsystems.com. Vision Access is Offered Through Many Web Sites The power of aggregated mutual fund and variable annuity customer account information is synonymous with DST Vision. We at Vision are committed to providing the foremost financial intermediary Web site, accessible directly at www.dstvision.com. However, we also work closely with the broker/dealer community and our participating mutual fund and variable annuity companies to make Vision easily accessible for you. This entails integrating Vision with the other Web sites on your browser’s favorites list. Vision is currently integrated into the Web sites of the following organizations: Broker/Dealers:

Fund Families:

Vision’s integration with broker/dealer and participating company Web sites provides increased efficiencies because you can seamlessly access sales and marketing material, or home-office notices, while you access aggregated customer account information. Additionally, many of these sites provide single sign-on. Your Vision ID and Password are your keys to access Vision through the URL destination of your choice. Regardless of how you access Vision, your profile characteristics, such as custom portfolios and e-mail alerts, remain intact. As always, Vision’s support team is ready to assist you with using the Vision Web site. Sales Tool Focus: Phone Numbers Now Available on Prospect Lists

In the last issue of the “The Vision View”, we announced Vision’s alliance with Acxiom Corporation’s Infobase, the most comprehensive U.S. consumer database available. Since then, hundreds of advisors have used this valuable tool to build custom mailing lists for direct marketing campaigns. Recent Enhancements

Cost-Effective Marketing On your next visit to Vision, click the “Find Prospects” link located in the middle of the My Assets page to incorporate this tool into your ongoing marketing program. How-to Corner: Options Available to Learn About Vision's Functions Did you know that Vision provides portfolio reports, transaction alerts, electronic statements, cost basis, and tax summary information? Vision offers so much content it can be challenging to understand and use its full suite of offerings. To help you realize Vision’s full potential, we offer several training options.

Based on demand, Vision representatives may provide classroom training in major cities across the United States in 2005. If you, or your administrative assistant(s), are interested in a free, comprehensive two-hour training on Vision, let us know what major cities are most convenient for you. Help Desk FAQ: Why do I get an error message when I request an account value from a specific date? Vision’s “Account Value by Date” feature, located on the Account Overview page, is very useful in monitoring performance trends for clients. When you request “Account Value by Date”, an account’s transaction history file is scanned to retrieve the share balance for the requested date. Once the shares are obtained, that amount is multiplied by the applicable NAV. However, many mutual funds perform annual transaction history purges in the summer, eliminating transactions that occurred during the previous tax-reporting year. In this situation, Vision will display a message noting that the calculation cannot be performed. To obtain the information, you can call the fund company directly to get the amount or review a prior statement and manually multiply the amount by the NAV. Advisor Case Study The DST Vision team values your input. This input helps Vision remain the Web site of choice for financial intermediaries. We recently interviewed Mike Wright, who works in Operations and New Business in the Veritrust Financial, L.L.C. home-office, located in Austin, Texas. The majority of Veritrust Financial’s business is with 403(b) retirement accounts.

VV: How long have you been using DST Vision? Wright: For about 2 years. VV: What initially drew you to Vision? Wright: When I started working with Veritrust, almost everyone in the office was using Vision so I looked in to it. I realized it is quick and easy to get online and look up the information I need in one location. It’s a great tool.

VV: How often do you use Vision? Wright: Most people in my office, including me, use Vision every day. VV: How do you use Vision? Wright: I use Vision to verify new accounts have been set up and funded. It's also valuable when I service shareholder calls, research compliance issues, and review transactions. VV: How has Vision helped you serve your clients? Wright: We are able to respond to our customers’ needs quickly. When they call for information and balances, we can provide it immediately without calling a bunch of different mutual funds. Vision is also helpful when we regularly review client accounts to ensure they are in line with their investment objectives. VV: How has Vision helped you grow your business? Wright: At Veritrust, using Vision is a benefit for attracting new representatives. It demonstrates that we help them be more productive. Vision is definitely an asset for us. VV: What other comments do you have about the Vision Web site? Wright: We just wish all companies would offer the electronic statements option. Editor's Note: The following companies currently offer electronic statements:

Vision Team Profile When you call 800.435.4112 or send an e-mail message to dstvision@dstsystems.com, there is a team of dedicated and knowledgeable individuals ready to address your needs. Over time, we will introduce each of the team members who are committed to providing you with the best possible customer service and a positive DST Vision experience. Spotlight on Garin Bledsoe

While training to be a police officer, Garin Bledsoe realized there were safer ways to help people. Soon after that, he joined DST Systems where he has worked for the past seven years. For the last year, Garin has worked as a client relations specialist for DST Vision. During his tenure at DST Systems, Garin has held leadership roles for teams managing major organizational and process changes, but his work with various support teams has been the most rewarding. “The best calls I get are from advisors who know very little about Vision. Advisors are excited when they learn about Vision’s functions and how helpful it can be in managing their business,” said Garin. Whether it’s adding management companies to advisor profiles or processing Vision IDs, Garin gets to do what he likes to do best: help people. “Every time the phone rings, I know it’s someone who needs my help. Being able to serve customers gives me great satisfaction,” said Garin. Garin’s hobbies include paintball, martial arts, and researching his genealogy – which he has traced back to 1652! Garin and his wife, an elementary school teacher, enjoy going to the park with their energetic sons, ages one and three. |